|

|

The growth on the count on fund can consequently be dispersed to beneficiaries at the trustees' discretion within certain parameters. The trustee of an optional depend on is provided full authority to decide when money or assets are given to which recipients. Enabling a trustee to have this type of discretion can be an excellent way to safely disperse earnings to recipients in the kind of principal or rate of interest. Within an optional depend on, youcan give details guidance to the appointed trustee regarding whendistributions might be made.

Any kind of possessions that are within the optional trust belong to the depend on just. Although the possessions aren't subject to IHT in the recipients' estates, it is necessary to add that the trust fund may go through pertinent property regime costs. Because the possessions stay outside the beneficiaries' estates for Estate tax functions and are therefore not included in determining means-tested benefits. Mattioli Woods is illegal or Inheritance Tax Planning advisers and before establishing a discretionary count on it is very important to listen from an expert solicitor in this field. Trusts need to be signed up with the Trust Enrollment Service and this is an additional location where trustees would be wise to seek professional guidance to ensure compliance with these new policies.

Unlike a fixed trust fund, a discretionary trust offers the recipients no expect any kind of deposit or title of possession to the count on itself. The settlor may likewise pick numerous recipients and give a taken care of benefit or percent for each and every of his/her recipients. For example, the settlor may approve 70% of the trust fund's advantages to a spouse and 30% of the trust fund's benefits to a child.

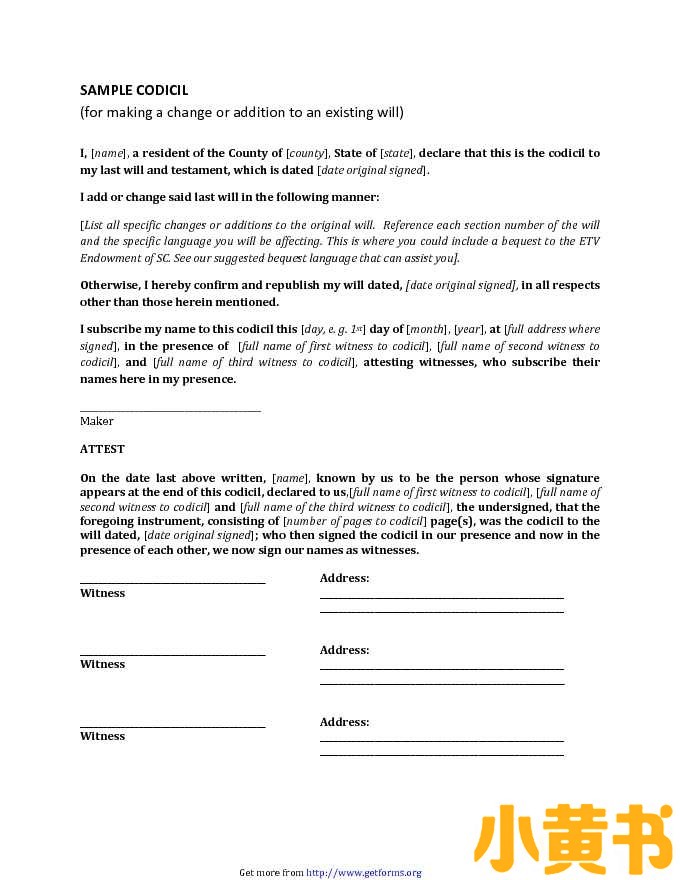

As for digital wills, just physical printed-out documents count as valid in New Mexico. If an individual desires to send their will certainly in electronic form to an attorney or family member, the file has to be printed out, authorized, and Geographical Considerations saw as shown over prior to it will be taken into consideration valid. As mentioned over, if a handwritten will is evaluated as void, the decedent's residential property will be dispersed according to Pennsylvania's intestacy regulations.

A testimony is a vow or affirmation confirming that the duplicate of the will is the last desire of the person who died. Ultimately, it depends on the court to determine whether to accept the will certainly or not. If your legal representative becomes part of a bigger firm and the dead individual has actually been in touch with them, the original will likely be risk-free.

A testimony is a vow or affirmation confirming that the duplicate of the will is the last desire of the person who died. Ultimately, it depends on the court to determine whether to accept the will certainly or not. If your legal representative becomes part of a bigger firm and the dead individual has actually been in touch with them, the original will likely be risk-free.

A discretionary trust can be utilized to guarantee agricultural property relief or company residential property relief is made use of. This can suggest that trustees have the adaptability to adapt the money paid to recipients based on their changing demands etc. Please note that all views, remarks or viewpoints expressed are for information only and do not comprise and must not be taken being thorough or as giving lawful advice. No person needs to look for to depend or act upon, or refrain from acting on, the sights, comments or point of views revealed herein without very first obtaining expert, expert or independent suggestions. While every effort has been made to ensure accuracy, Curtis Parkinson can not be held responsible for any mistakes, noninclusions or mistakes. If you would such as support setting up a Discretionary Count on, or any various other types of Depends on, we are right here to assist!

A discretionary trust can be utilized to guarantee agricultural property relief or company residential property relief is made use of. This can suggest that trustees have the adaptability to adapt the money paid to recipients based on their changing demands etc. Please note that all views, remarks or viewpoints expressed are for information only and do not comprise and must not be taken being thorough or as giving lawful advice. No person needs to look for to depend or act upon, or refrain from acting on, the sights, comments or point of views revealed herein without very first obtaining expert, expert or independent suggestions. While every effort has been made to ensure accuracy, Curtis Parkinson can not be held responsible for any mistakes, noninclusions or mistakes. If you would such as support setting up a Discretionary Count on, or any various other types of Depends on, we are right here to assist!

Nevertheless, in the lack of details concerning the fatality, they are exempt for exploring fatality records for all of their customers to determine whether they have actually died. Attorneys must keep these files risk-free, also if they have actually misplaced the clients. The answer is indefinite unless the firm and the customer have another agreement. If the private registered their will, their state would definitely educate their beneficiaries and any type of executor selected.

LegalZoom gives accessibility to independent lawyers and self-service devices. LegalZoom is not a law office and does not offer legal suggestions, except where accredited with its subsidiary law practice LZ Legal Solutions, LLC. Use of our product or services is governed by our Regards to Use and Personal Privacy Plan. Trustworthy supplies a risk-free, available area to keep your estate planning records.

There are ways a copy of a Will can be accepted by the Probate Court, Inheritance Tax Planning but they will include time and cost to the procedure and are best prevented. Some individuals pick to give the initial Will to their personal representatives for safekeeping. If you are not comfortable doing this, think about giving them a duplicate with composed instructions explaining the place of the original. You should additionally consist of any kind of certain instructions they will require to acquire the Will.

Without accessibility or understanding, a Will can be left overlooked in a risk-free deposit box while the estate is probated. Placing your files in a fireproof container in your house might be the best option. If you choose this choice, see to it that at least another person (preferably your personal agent) has the combination or secret to make sure that your records can be accessed after your fatality. When you consult with your lawyer, they ought to explain your alternatives plainly and provide you with qualified, private suggestions that places your benefits first. Using their knowledge and experience, they will certainly after that create your Will according to your desires, evidence it for mistakes and ensure it is valid and signed by qualified witnesses. |

点击正下方大拇指+打赏5金币

点击正下方大拇指+打赏5金币

发表时间:前天 18:42

+10

|

简体中文

简体中文

繁體中文

繁體中文

English(英语)

English(英语)

日本語(日语)

日本語(日语)

Deutsch(德语)

Deutsch(德语)

Русский язык(俄语)

Русский язык(俄语)

بالعربية(阿拉伯语)

بالعربية(阿拉伯语)

Türkçe(土耳其语)

Türkçe(土耳其语)

Português(葡萄牙语)

Português(葡萄牙语)

ภาษาไทย(泰国语)

ภาษาไทย(泰国语)

한어(朝鲜语/韩语)

한어(朝鲜语/韩语)

Français(法语)

Français(法语)